Black Friday 2025 is delivering the kind of streaming deals that make even seasoned cord-cutters do a double take. We're talking about discounts so aggressive they fundamentally reshape the value equation for premium content—and honestly, it's about time the streaming wars translated into real savings for consumers.

Let's break down what's happening in the streaming deal landscape right now, because many streaming services will offer the biggest discounts of the year right now — in the run-up to Black Friday. What makes this year particularly noteworthy is how even traditionally premium-positioned services are willing to slash prices dramatically to compete for your attention.

The Market Leaders Go Aggressive

HBO Max Sets the Pace

HBO Max is offering a deal of $2.99/month for 12 months (save $8/month), which represents a fundamental shift in how premium content gets priced. When you consider that it lets you get the streaming service for $2.99 per month, which is a giant discount off the $10.99 price it typically costs, you're essentially paying less than many people spend on coffee while getting access to HBO's entire content library, including major theatrical releases and prestige series.

This deal runs until December 1, 2025, giving you a clear window to lock in what amounts to premium content at basic cable pricing. The strategic implications here are significant—HBO is essentially betting that a year of engagement at drastically reduced pricing will convert into long-term subscribers willing to pay full price.

Apple TV+ Breaks Character

Apple's approach to this Black Friday represents a notable departure from their typical premium-only strategy. Apple TV has a rare deal for 2025, which knocks over 50% off the first six months of service, with Apple TV's monthly subscription rate down from $12.99 a month to $5.99 a month for half a year.

What makes this particularly interesting is that Apple rarely plays the discount game this aggressively. The fact that they're offering substantial savings suggests they're serious about building subscriber base beyond their existing ecosystem. The sale on Apple TV lasts until December 1, 2025, aligning with HBO Max's timeline and suggesting coordinated market pressure.

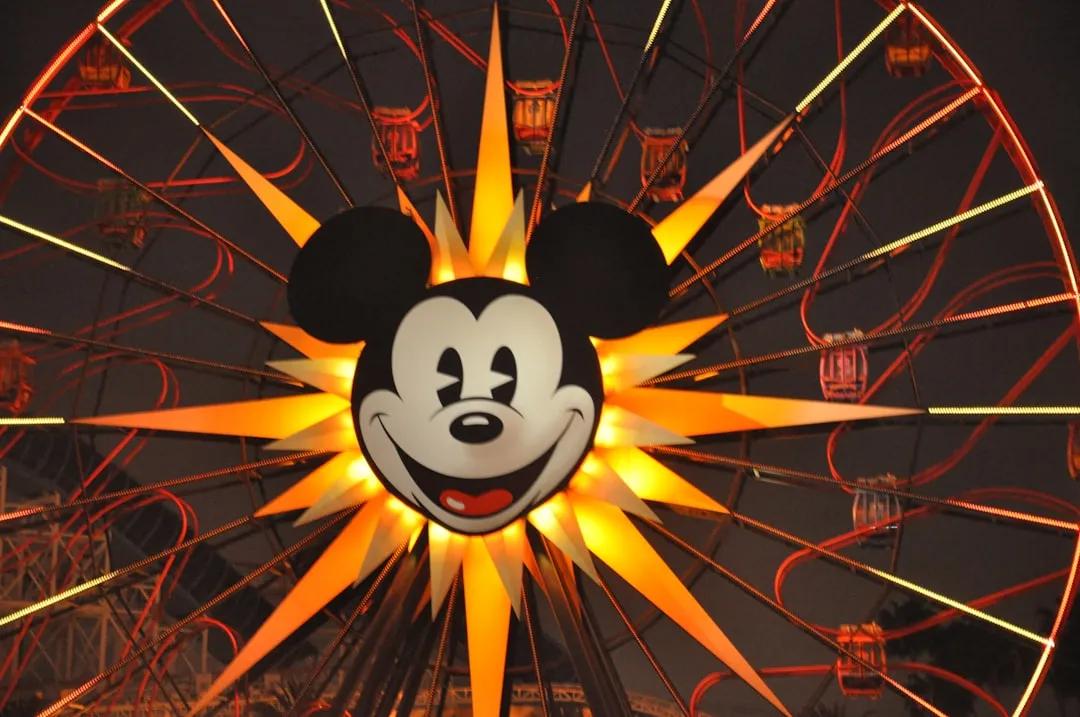

Disney's Strategic Bundle Evolution

Disney's approach focuses on their ecosystem play rather than individual service discounts. You can get ad-supported Disney Plus, ad-supported Hulu, and ESPN Unlimited for $29.99 a month for 12 months, which becomes compelling when you analyze the content value per dollar.

This deal, running through January 5, 2026, essentially gives you family entertainment, adult programming, and comprehensive sports coverage for less than what many single services charge at full price. The extended timeline suggests Disney is confident about converting promotional subscribers to full-price customers post-deal.

The Deep Discount Champions

The most aggressive pricing this year comes from services willing to essentially give away content to build market share. Customers can get a full year of STARZ for just $11.99, a nearly 83% discount from the standard yearlong plan pricing. At essentially a dollar per month, this represents loss-leader pricing designed to establish viewer habits.

Similarly, Frndly TV (3-month): now $0.99/ month @ Frndly TV targets families looking for clean, affordable content options. While Frndly TV operates in a niche market, this pricing makes it practically free to try their approach to family-friendly streaming.

Amazon's Channel Strategy Disruption

Amazon's approach this Black Friday demonstrates sophisticated platform thinking. Rather than discounting Prime Video directly—since it comes bundled with Prime shipping benefits—they're going deep on channel add-ons, creating a pick-your-adventure content experience.

Prime Video add-on subscriptions: deals from $1.50 @ Amazon covers an impressive range of specialty content, with standout deals including:

- MGM+ add-on via Prime Video (2-month): now $1.99/month @ Amazon

- AMC+ add-on via Prime Video (2-month): now $1.75/month @ Amazon

- BET+/Starz bundle via Prime Video (2-month): now $3.99/month @ Amazon

The scale here is remarkable: Amazon has discounted 8 bundles and 24 standalone Prime Video add-on subscriptions including HBO Max, MGM+, BritBox, Hallmark+, Starz, Apple TV, and others. This strategy transforms Prime Video into a content distribution platform where consumers can essentially build custom streaming packages at dramatically reduced trial pricing.

Live TV Services Enter the Discount War

Live TV streaming services, which typically maintain premium pricing due to high content licensing costs, are also participating in aggressive discount strategies. YouTube TV: now $72.99/month @ YouTube represents a $10 monthly discount on what many consider the gold standard for live TV streaming.

For sports-focused viewers, Fubo: now $54.99/month @ Fubo becomes particularly compelling. Fubo's sports-heavy channel lineup at this price point offers significant value compared to traditional cable alternatives, especially for households that prioritize live sports coverage.

The Walmart+ Content Integration Play

The most innovative value proposition might come from an unexpected source: Walmart. Right now, you can get Walmart Plus for a whole year for just $49 and get Paramount Plus or Peacock for free, with Walmart+ annual plans 50% off.

What makes this particularly clever is the flexibility: you can switch which streaming service you get for free every 90 days with Walmart Plus. This transforms Walmart+ from a shopping membership into a streaming platform aggregator, while adding value through shipping benefits, gas discounts, and other perks.

Strategic Implications for the Streaming Market

The breadth and depth of these discounts signal several important shifts in the streaming landscape. First, the market has reached a maturity point where subscriber acquisition costs justify aggressive promotional pricing. Second, services are betting that content engagement during extended trial periods will drive long-term retention even after prices return to standard rates.

The timing coordination is also telling. The period from the week of Thanksgiving through the first week of December is the best time for streaming offers, and most streaming deals launch on Thanksgiving or Black Friday morning and run through Cyber Monday. This year, however, many deals extend well beyond the traditional Black Friday window, with some running through January 2026.

This suggests services are less focused on short-term promotional spikes and more interested in establishing longer-term subscriber relationships during the crucial winter viewing season.

Consumer Strategy Considerations

These deals represent legitimate opportunities to lock in substantial savings, but smart consumers should approach them strategically. The key consideration is content consumption patterns—which services align with your actual viewing habits over the 6-12 month promotional periods most deals offer.

For households that consume diverse content, the Amazon Prime Video channel strategy might offer the most flexibility, allowing you to sample multiple specialty services at dramatically reduced costs. Families with children might find the Disney bundle compelling, especially with sports content included. And for premium content focused viewers, the HBO Max deal represents exceptional value for high-quality scripted content.

Bottom line: if you've been considering expanding your streaming options or want to lock in savings on current subscriptions, this Black Friday represents one of the most aggressive discount periods we've seen. Just remember to set calendar reminders for when promotional pricing ends—nobody wants surprise billing at full price when these deals expire.

The market has clearly shifted from subscriber growth at any cost to subscriber growth at strategically discounted costs, and consumers are the primary beneficiaries of this evolution.

Comments

Be the first, drop a comment!